—–For general audience—–

Canadian government confuses BEPS attempts with bank cash pool product.

Nowadays more and more scrutiny is applied to combat base erosion and profit shifting attempted by multinational corporates. The usual suspect in this combat are transactions conducted among group companies. More specifically, authorities look at lending and borrowing activities between group companies and seek for any possible base erosion and profit shifting. This can lead to misinterpretation and confusion. In this post a closer look.

Base Erosion and Profit Shifting [1]: refers to tax planning strategies used by multinational enterprises that exploit gaps and mismatches in tax rules to avoid paying tax … artificially shift profits to low or no-tax locations where there is little or no economic activity or to erode tax bases through deductible payments such as interest or royalties.

By Wendy Cha

Visit the blog-page for this and more articles (click here).

The issue here is that when authorities look into these transactions, they do not realize that there are many different ways and structures of how transactions are set up and each respective transaction’s intentions. In this manner, Cash Pooling, offered by banks, aimed to maximize efficiency in managing intragroup liquidity, is sometimes erroneously regarded as camouflage for hiding intragroup/intercompany transactions and become target for the combat.

The reason why Cash Pooling in general becomes an easy target for the combat is because it involves numerous entities from various countries of an MNC (multinational corporate), and because it supports funding among themselves. Moreover, Cash Pooling itself has many different structures and set-up which makes it even more confusing for authorities. The most prominent two Cash Pool structures are Notional and Physical.

Notional

As the word ‘notional’ indicates, notional Cash Pools do not involve any physical movement of cash between group entities, but ‘notionally’ regards cash balances from different legal owners (in different names) as one balance. With this balance, it allows entities to borrow its funding needs or deposit excess cash. Let there be no misunderstanding, if funds get concentrated (i.e. there is change of ownership of funds) it is not notional. Banks offering notional Cash Pooling eliminate risk with cross guarantees or mitigate risk with pledges.

Physical

Physical cash pool, does involves physical movement of cash to bring cash balances in different names into one entity’s account. Not only the basic structure differs but also legal framework, set up, and responsibility of each player is completely different.

Canada

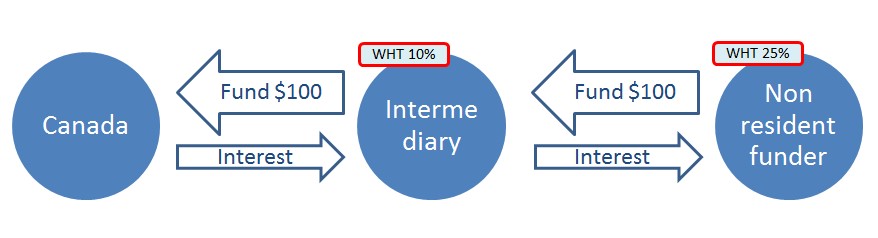

Recently, among many countries which are trying to fight against BEPS, Canada has taken action of introducing the – so called – back-to-back-loan-rule in 2014 and expanded its application in 2016. The intention is obviously to fight against tax avoidance in back to back loan structures. However due to the seeming similarity between back to back loan and Cash Pooling, the Canadian tax authority views these two different products identical, and applies back to back loan rules to Cash Pooling.

Keep in mind that even when this new rule is applied, it still does not prohibit Canadian entity from joining a back to back loan or a Cash Pool. It merely leads to a higher withholding tax rate to be applied.

In this scenario, Canadian expanded back to back loan rule would regard funding to be ultimately done from non-resident funder and thus apply 25% WHT. [2][3]

Even though one could argue that by applying back to back rules, the withholding tax rate applied is only slightly higher, it still doesn’t seem to be correct to apply this new rule to somewhere not applicable. The intention of back to back loan rules is to prevent MNC’s from using financial institutions as conduit or intermediary in between their financial transaction to (intentionally and as main purpose) seek for a lower withholding tax rate. There are cash pool structures where banks are acting as only conduit, playing no active role whatsoever and not taking any FX or credit risk. In this case, it seems difficult to shy away from back to back loan rule. And righteously so. However, there are also other Cash Pool structures, notional structures, where bank is playing a role which is far more than a conduit, taking risk and actively managing currency position. In case of notional Cash Pooling structures, banks are not merely passing on fund from funder to borrower but are to be deemed as a direct contract party of each participating party individually and thus get exposed to various sorts of risk.

In addition, back to back loan rules are looking into intercompany transactions which are guised as mere financial transactions. Physical Cash Pooling has difficulty proving itself as mere financial transactions as funds flow into one hand and ownership of funds changes. Likewise for notional Cash Pools whereby the structure is based on cross guarantees. With this framework, cross guarantees are made amongst participating entities. The bank is not a party in these cross guarantees and solely facilitates the transactions.

Notional Cash Pools with a pledge structure, should not necessarily be perceived as an intercompany (intragroup) transaction, but mere financial transaction. Deposits are pledged to bank and bank uses this deposit as collateral to lend fund to borrowing entities. As direct counter party for depositing and borrowing is the bank itself, deposit and borrowing are not linked among participating entities. Depositor, owner of asset, can withdraw its fund even if debt in cash pool is not repaid. Moreover, interest is determined by bank and recorded as bank’s profit and loss and gets taxed accordingly. As interest is bank’s profit, bank can freely dispose of its interest revenue. This proves even further that cash pool with pledge framework is mere financial transaction.

ConclusionWhen we look at the intention of Canadian back to back loan rule, it focuses on intercompany (intragroup) transactions which are immorally guised as financial transactions and aim specifically for tax avoidance. However, there are mere financial products which, at first glance, are structured in a very similar way but aim for a totally different goal, which is to efficiently manage liquidity within one group company. These “innocent” products do not have any immoral intention but just good will to assist MNC’s in managing their cash. Furthermore, not only the intention, but also differences lie in role, risk, legal and structural framework of what the new rule is looking after and how bank cash pool products are structured. Physical cash pool product might have more difficulty proving itself as mere banking product, whereas notional cash pool has more ease. In either way, the new rule should look into more details and identify genuine intention of each transactions and products and then determine its application.

Visit the blog-page for this and more articles (click here).

DisclaimerFootnotes: [1] Definition of BEPS from OECD page. https://www.oecd.org/tax/beps/about/ [2] Full Bill C-29, Budget Implementation Act, 2016, No. 2 from Parliament of Canada, https://www.parl.ca/DocumentViewer/en/42-1/bill/C-29/first-reading [3] Explanation about Bill C-29, Budget Implementation Act, 2016, No. 2 by PWC, https://www.pwc.com/ca/en/services/tax/publications/tax-insights/bill-c-29-significantly-expands-back-to-back-rules.html

Featured image: Canadian embassy in Seoul, South Korea

The views in this post solely reflect the opinions of the author and not necessarily those of the institutions with which he/she is affiliated.

In the posts the author(s) express(es) personal insights, expert views, and opinions with respect to the topic(s) discussed. Due to differences in interpretation, insights may (and will) differ.