A closer look at how a (publicly) listed subsidiary of a Chinese multinational could not repay a RMB 1 billion matured bond, even though RMB 12.2 billion of free cash was recorded. And how this attracted (negative) regulatory attention.

As it turned out, the listed company participated in a group level zero-balancing Cash Pool. Hereby the balances of the accounts of all participants were swept to a – so called – header account (master account if you like). However, the swept-away cash, instead of being classified as “connected transactions”, was improperly disclosed as “cash” on the balance sheet, leading to inappropriate reflection of the true liquidity of the listed company.

Though the case study focuses on China and Hong Kong, the characteristics can be applied to most other countries as well.

By Shining Lin (l) and Jiaxin Huang (r)

Visit the blog-page for this and more articles (click here).

This case reveals why nowadays the listed companies are more strictly regulated by China and Hong Kong stock exchange markets as it pertains to connected transactions. Improper disclosure of connected transactions can significantly harm the interests of majority shareholders and public investors.

Please bear in mind that , “listed company” in this article refers to those subsidiaries of a (multinational) group which are separately or independently listed on certain stock exchange markets. This is different than those multinational whereby only the parent company is listed

Although the rules which apply to listed companies (hereafter referred to as “listed company rules”) don’t prohibit outright listed companies to participate in Cash Pool arrangements, we observe that this nowadays draws attention from the regulators. Consequently listed companies take a very cautious approach.

In a series of two articles we will further elaborate on these topics with specific focuses:

Article I: Listed company rules regarding connected transactions in China and Hong Kong stock exchange markets and the intention of preventing bad intentions behind the connected transactions;

Article II: Whether it poses risk for listed companies if they join Cash Pool, in particular multi-currency multi-entity notional Cash Pool? What are the risks inherent? And what can be the solutions? (click here)

There is RMB 12.2billion cash on the balance sheet,

But the company cannot repay the RMB1billion debt. What is the problem?

Case Study: The Kang De Xin Cash Pool cause and effect in a nutshell.

Early this year, the stock price of a Chinese listed company (Kang De Xin) plunged sharply due to the default[i]of its two bonds (18Kang De Xin SCP001, 18 Kang De Xin SCP002). Though RMB 12.2 billion cash deposit was stated in its bank confirmation statement, the bank verbally confirmed the inability to repay a debt of less than 10 percent of the free cash. So what happened to the deposit? Why can’t the account holder utilize its own and seemingly free funds to repay the debt? As the bank later announced in an official statement, the listed company participated in the group’s zero balancing Cash Pool, and the RMB 12.2billion on the account was swept to a head account, leaving the available balance on its own account as zero. The funds were gone.

Common in any zero balancing Cash Pool systems in China or elsewhere, balances on the account of participants will be swept to the head account on a real-time (or end of day) basis which, due to the fact that the legal ownership of the funds changes, triggers (or should trigger) an intercompany loan. In terms of accounting disclosure, the “cash balance” should be accounted as “other receivable from group”. When Kang De Xin entered into a zero balancing Cash Pool agreement with its group companies, the agreement facilitated the funds of the company transferred to the parent company. The funds were then ultimately owned by its controlling shareholders. Furthermore, the company disclosed swept-away cash as account balance in its own book instead of connected transaction with its controlled shareholder, concealing the true liquidity position of the company. In essence this harms the minority shareholder.

Why regulators care so much about connected transactions?

There is no right or wrong with connected transactions. However, the listed company rules require connected transactions to be properly disclosed. This is to prevent bad intention which may be potentially hidden behind the transactions. The case above is a common example that listed company’s cash is transferred to its controlling shareholders, thus benefiting the controlling shareholders but ultimately harming the listed company and its investors.

In a recent research paper about China equity market, the percentage of connected transactions between group companies controlled by the same parent is as high as 63%[ii]. It indicates that the chance that controlling shareholder abuses the listed companies’ funds are quite high. Therefore regulators are asserting pressure to listed company to follow the rules of disclosing connected transactions.

The listed company rules don’t forbid Cash Pool arrangements, but are intended to ask the companies to follow the rules.

What are the relevant rules which Corporate Treasurers should pay attention to?

In Hong Kong listed company rules, there are regulations specifically catered for governing connected transactions. The definition of connected person and connected transaction are explicitly listed out. The listed company rules in mainland China as it pertains to connected transactions are comparably boarder. In the section “Reference: Terminologies and relevant rules regarding connected transactions in Hong Kong and China” below, further details on the definition of the connected person, financial assistance and guarantee, codified the independent advice, requirements (advisory, circular, approval, reporting), exemptions and ongoing review is summarized.

Substance over form is an important principle in disclosing the connected transaction.

Conclusion: Take a closer look at Cash Pool.

There is no specific rule that prohibits listed companies to participate in any kind of Cash Pool. But as there are many different sorts of Cash Pools provided by different banks, it pays to take a closer look at how to disclose. Zero balancing Cash Pools are noticeably more tricky from a reporting perspective due to their inter-company nature. For example, funds are physically transferred and put onto a big pile. It takes extra efforts for the companies to figure out the amount borrowed or lent among each other. Besides, who decides the interest rate? Whether the interest rate conforms to arm’s length rule? How the interest will be calculated and allocated etc.?

There are also more friendly Cash Pools whereby no physical movement of funds is required. In the next article, we will take a closer look of this more advanced structure and analyze: What is the true risk for listed company? How the listed company rules are relevant with this specific form of Cash Pool? What could be the best way forward for those listed companies that aim to achieve liquidity concentration and respect disclosure rules at the same time?

Featured image: The “money wall” in the new trading floor (namely Hong Kong Connect Hall) of Hong Kong Stock Exchange. The wall features a host of different money-related Chinese characters.

Background information:

Reference: Terminologies and relevant rules regarding connected transactions in Hong Kong and China.

The following paragraphs cover terminologies regarding connected transactions and relevant rules which listed company should adhere to.

In Hong Kong listed company rules, Chapter 14A[iii] is specifically catered for governing connected transactions. The definition of connected person and connected transaction are explicitly listed out. The listed company rules in mainland China[iv] as it pertains to connected transactions are comparably boarder[v].

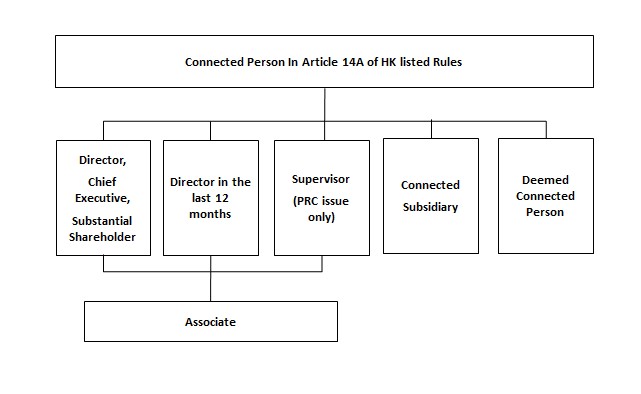

- The connected person

*source: Chapter 14A.07 connected transaction Hong Kong equity rules

“Connected Persons” of a listed company are persons who can control or exercise significant influence over the group or who stand to benefit from transactions with the group. They include senior executives and substantial shareholders of the listed company or its connected subsidiary, and any persons closely associated with them. It is worthy to mention “Connected Subsidiary” which is the listed company’s non-wholly-owned subsidiary if it is substantially held by senior executives and/or substantial shareholders of the listed company (and/or their associates), or as long as aggregated 10% of voting power at the subsidiary’s general meeting can be exercised (see chapter 14A.16).

In the listed company rules of Shanghai equity market, the connected person is defined in general terms, i.e. any legal or nature person directly or indirectly controlling the listed company falls into the scope. To be more precise, the rules will apply if the person has above 5% of ownership of the listed company or above 10% of any influencing subsidiary.

- Financial assistance and guarantee

In Hong Kong, the regulators take closer look at connected transaction and in a boarder scope. For example, in 14 A.24 “Financial Assistance” refers to granting credit, lending money, or providing an indemnity against obligation under a loan, or guaranteeing or providing security for a loan.

Comparably, in Shanghai and Shenzhen markets, the regulators zoom in to “Guarantee”. All guarantees regardless of value should be disclosed and approved by directors’ resolution. If the guarantee is received by a connected person, it should be approved by shareholder’s meeting (Chapter 10.2.6 of Shanghai listed rules). In a Cash Pool arrangement which listed company, its controlling parent company and its connected subsidiaries join at the same time, although there is no physical financial assistance, the guarantee provided to Cash Pool participants shall follow the rules to be disclosed.

- Codified the independent advice

According to Company Ordinance in Hong Kong, the company shall appoint an independent board committee[vi] (the “IBC”) to advise the independent shareholder in respect to transactions contemplated for the purpose of connected transactions. In Hong Kong listed company rules, Chapter 14A.40 explicitly elaborates the responsibilities and obligations of independent board committee. For example, the committee makes recommendation of an independent financial advisor as pertaining to entering into connected transaction, and makes judgement on whether the terms of the transaction are fair and reasonable. In Kang De Xin’s case, there might be some overlook from relevant independent parties to look into the relevant connected transactions.

In additional, both Hong Kong and Shanghai/Shenzhen equity markets indicated that any legal representative or financial advisor who has direct interest or connection with the transaction and the listed company shall avoid voting and present the advice.

- The Full set of requirements: Advisory, circular, approval, reporting.

The general requirements for connected transactions include disclosures in announcements, circulars and annual reports, and shareholders’ approval. Independent board committee makes recommendation to shareholders on whether certain connected transaction is fair and reasonable. In Hong Kong, the independent board shall employ an independent financial advisor. In China, auditor’s opinion is sufficient. The opinion must be set out in the form of circular to its shareholders for approval. The shareholders will vote whether they are in favor of the connected transaction. The listed issuer’s annual report must contain certain elements that address relationship with the listed company and how the interest is allocated.

- Exemptions

For companies listed in Hong Kong, to reduce listed issuers’ compliance burden, exemptions and waivers from all or some of the connected transaction requirements are available for specific categories of connected transactions. These apply to connected transactions that are immaterial to the listed issuer’s group, or specific circumstances where the risk of abuse by connected persons is low. The exemptions are broadly divided into two categories: (1) fully exemption: exempt from shareholders’ approval, annual review and all disclosure requirements; and (2) partial exemption: exempt from shareholders’ approval requirement. Before submitting the transactions for shareholders’ approval, employing an independent financial advisor is necessary and that is very costly. Therefore, the benefits for entering the transactions needs to be assessed.

For companies listed in Shanghai and Shenzhen, there is no explicit exemptions. However, any transaction below absolute amount of RMB 300,000 or weights less than 0.5% of net assets based on the recent audited financials is waived from approval.

- Ongoing review if it is continuing connected transaction

As long as the connected transaction is carried out on a continuing or recurring basis and is expected over a period of time, the on-going review is required. It means that if there is any change in the limit or terms, the listed company must re-comply with the shareholders’ approval requirement before limit is exceeded or material changes are affected to the terms of the agreement. If there is no material change, the listed company can just disclose the transactions as required in the financial reports.

Visit the blog-page for this and more articles (click here).

Featured image: The “money wall” in the new trading floor (namely Hong Kong Connect Hall) of Hong Kong Stock Exchange. The wall features a host of different money-related Chinese characters.

The views in this post solely reflect the opinions of the author and not necessarily those of the institutions with which he/she is affiliated.

In the posts the author(s) express(es) personal insights, expert views, and opinions with respect to the topic(s) discussed. Due to differences in interpretation, insights may (and will) differ.

[i] https://finance.sina.com.cn/stock/s/2019-01-21/doc-ihqfskcn9205267.shtml

[ii] [金融市场]浅析上市公司关联交易信息披露,吴婉瑜。

[iii] Chapter 14A Equity Securities connected transactions.

[iv] 上海证券交易所股票上市规则,2014年10月第九次修订;深圳证券交易所主板上市公司规范运作指引(2015年修订)。

[v] Regulations for connected transaction in China are embedded in various laws and even circulars issued by China Security Commission and Shanghai/Shenzhen stock exchanges; the circulars hereby refer to <中国证券监督管理委员会、国务院国有资产监督管理委员会关于规范上市公司与关联方资金往来及上市公司对外担保若干问题的通知(2018最新版)>,< 主板信息披露业务备忘录第2 号——交易和关联交易(深圳证券交易所公司管理部 2015 年4 月20 日、2018 年3 月27 日修订)>,<上海证券交易所上市公司关联交易实施指引>。

[vi] Independent Board does not hold any position in the company, and he/she does not engage with company business, but will provide independent opinion for the company affairs. Independent Board Directors (IBDs) are non-executive directors(NEDs) who are deemed independent by the Board. IBDs have the duties of the NEDs, and additionally provide an independent and objective check on Management.

One thought on “Is the Cash Pool properly disclosed? Must know for Treasurers. (1/2)”